Written by an industry expert, mentor, and partner; if you have ever thought about paths to grow your business this article by Michael Peterson is exactly what you need to know to about the path of franchising.

When a business considers its next phase of development, franchising often comes into the discussion. That shouldn’t come as a surprise; when you look at the 12 most recognized food restaurant logos in the world,1 11 of them are franchised brands, 9 out of 10 of the most valuable fast-food brands are franchised,2 and roughly ½ of the world’s top retailers offer a franchise or license model.3

Franchising as a growth model is not just a consideration for emerging brands. Recently, I was asked to consult with a specialty clothing manufacturer with a presence in 30 countries; they are considering franchising as a possible avenue for their next growth phase.

What Is Franchising

If you are going to evaluate franchising as a potential growth vehicle, first you have to understand what franchising is. There is no one universally accepted legal definition of a franchise relationship. The UK Common Law System does not have an “official” definition of “franchising” at all, the Consumer Protection Act (2008) of South Africa essentially defines “franchisees” as consumers, with many of the same protections, whereas Italy defines a “franchise” as an agreement between two legally and economically independent entities for mutual consideration.4 Though there is not a single legal definition, a good starting point for discussion is that a franchise relationship, at its core, is a relationship built around a license agreement and services agreement. One party (the franchisor) licenses to the other party (the franchisee) certain rights in respect to its trademarks, trade name, business systems, etc., and also agrees to provide certain services. The other party (the franchisee) typically agrees to abide by certain rules regarding the conduct of its business, and also to pay the licensing party some fee or set of fees.

Considerations Of Franchising

There is an oft-repeated saying in U.S. franchising: “any business can be franchised; most businesses shouldn’t be.” While in some jurisdictions the first part of that saying may not be true, the second part is ubiquitous.

A feasibility study determines if a business is appropriate for franchising. This is a subject I explore at length in How and Why to Franchise Your Business, and also a subject that is outside the scope of this article. Determining if franchising is viable is only the first step, however. The real question is whether it’s the best choice for your business expansion plans. Like any other business model, franchising has its pros and cons. The impact of each varies significantly from business to business, and it is the sum total of these that should influence the decision to include or exclude franchising as part of your growth strategy.

The Pros of Franchising

Talent Pool

Innovators and extremely talented people are often frustrated with building someone else’s business. Individuals who disproportionately contribute to a team or company’s success often make the decision to contribute to their own instead through entrepreneurship. Especially for those individuals who have spent years in the corporate environment, “going it alone” can be a scary proposition, however. Franchising allows a bridge; franchisees are in business for, but not by, themselves.

Rapid Market Penetration

Expansion is costly. For a company to rapidly expand across multiple markets, either domestically or internationally, is often an endeavor too expensive to contemplate. Franchisors are able to expand by leveraging the capital investment of franchisees, sidestepping a large part of the capital expenditures of corporate expansion.

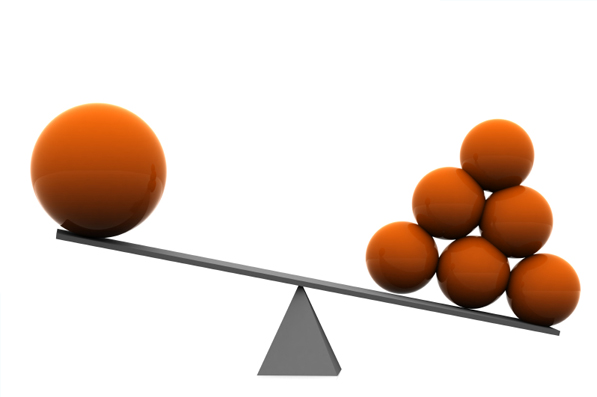

Spread Of Risk

First, to dispel a myth: franchisors do not completely eliminate their risk though franchise expansion. As several recent high-profile cases have shown,5,6 franchisors still have risk in areas as disparate as employment law and customer data protection. Having said that, a franchisor typically has significantly mitigated risks comparatively to a similarly-situated non-franchised organization.

Ownership Mentality Versus Manager Mentality

Franchise owners are just that – owners. Whereas managers may or may not take “ownership” of the business they are managing, franchisees typically look at their franchised business, including its reputation, appearance, and success (or lack thereof) as a direct reflection of themselves.

Beyond The Bottom Dollar

Sanjay Gehani is the Chief Marketing Officer and one of the founders of Building Kidz Worldwide, a preschool franchise with locations in the United States and India. When asked about one of the surprising benefits of franchising, Sanjay shared with me:

When we were considering franchising, the driving factors where the benefits to the children coming to our campuses, the staff, the communities in which we would be serving, and the children benefiting from our non-profit work. What wasn’t even on my radar, however, was the real economic benefit to the families of our franchisees. I now see that every day, and it makes what we do all the more worth it.

It’s easy to tote the good but it is equally if not more important to learn about the flip side. Getting excited about a path is really easy if you are talking to a sales like consultant that has his own pockets in mind over your own. Make sure you ask the questions and get a full picture before making any moves. Here are is the flip side of franchising.

The Cons

Of course, for every rose, there are thorns, and the franchised model has challenges. Again, Sanjay Gehani:

I knew that each franchisee would require a serious time investment and that the work would be significantly different than what my corporate career had prepared me for. Looking back, the thing that truly caught me off guard, however, was the energy required to help a franchisee quickly get through the training, site location, and opening process. There is a constant sense of urgency and go I wasn’t prepared for.

Less Control

You cannot fire a franchisee. Think about that for a second. If you franchise your business, someone will be operating under your trademarks, managing the day to day operations of a location that represents your brand, and they can’t be fired. To remove a franchisee, you have to in some way terminate the franchise agreement, and though the circumstances in which you can do so vary wildly from jurisdiction to jurisdiction, it’s always significantly more difficult (as it should be) than terminating an employee.

Less Per-Unit Revenue

With less risk naturally comes less reward. Franchisors typically receive a percentage of gross revenue for each franchised location. The obvious benefit is that the franchisor receives compensation regardless of profitability.

In many businesses, however, the majority of costs are fixed expenses such as rent and utilities, with variable expenses based on business volume like inventory or additional payroll accounting for a smaller percent of the overhead.

To illustrate this point, let’s imagine a business in which the fixed operating costs are $400,000 per year, and that beyond this “break-even point,” 40% is used to pay variable expenses, and the remaining 60% is profit. Using these base numbers, and an assumed royalty of 7% in the franchised model, we can quickly compare the per-unit return of a corporate-owned location and a franchised location.

|

|

Profit |

| % over break even |

Revenue |

Corporate |

Franchised |

| 10% |

$440,000.00 |

$24,000.00 |

$30,800.00 |

| 25% |

$480,000.00 |

$48,000.00 |

$33,600.00 |

| 50% |

$600,000.00 |

$120,000.00 |

$42,000.00 |

As you can see, achieving 50% over-break-even revenue results in 130% profit increase for the corporate owned location, but only 30% for the franchisor in a franchised location.

Brand Risk

A franchisor gives a franchisee a license to use its name, brand, trademarks, etc. Effectively, the franchisee becomes the brand ambassador in their area. Franchise agreements are notoriously hard to get out of, so if you make a wrong decision on who you bring into your franchise, the franchisee may cause damage to your brand in its trade area for a long period of time. Many young franchisors struggle to pay their corporate bills on royalties alone and need infusions of cash from franchise sales to keep the company running. This, in turn, can lead to bringing the wrong individuals into the franchise out of desperation. These short-sighted decisions can haunt a franchisor for years. Going off-shore multiplies this risk, as there has to be both training and adjustments within the brand for cultural differences.

Again, Sanjay Gehani:

The one thing that, looking back, caught me off guard with respect to operating a location in India, was the energy required to transfer knowledge and enable key operational decisions to be made locally.

Mitigation

Franchisors are able to mitigate many of the risks in franchising simply following good business practices.

- Be extremely selective to whom you award a franchise. Ask yourself if you would consider partnering with them. If the answer is no, don’t sell them a franchise.

- Engage your franchisees. Have an advisory committee. Listen to your franchisee’s ideas, and be open to change. After all, a franchisee developed the Filet-O-FishⓇ!7

- Create a culture of emotional connection. Implement programs that reward franchisee success, and recognize the franchisees that represent your brand at a high level. Be proud of your brand, and do your best to instill brand pride throughout your organization.

- Be intentional. If you are going to expand internationally, do so intentionally, bring in the right personnel up front that understand the challenges from a legal, cultural, and organizational level, and how to address those challenges.

Not If, Which?

Business expansion comes with risk. The risk of national corporate expansion is typically significant cash outlay and/or significant debt exposure, as well as long-distance recruitment and management. The risk of franchising is allowing someone else to use your name; someone that you can’t just fire if you don’t like their performance. Each company must evaluate for themselves what avenue of expansion is in their future.

Which Risk are you going to choose on your business expansion? What questions do you have that pertain to your specific industry? With goals you have set, what is the path you need to take to get there? So many options, we hope this has helped clarify one direction you can take.

Endnotes

- “A Brief History on the 12 Most Well-Recognized Restaurant Logos.” https://www.deputy.com/au/blog/a-brief-history-on-the-12-most-well-recognized-restaurant-logos

- “Most valuable fast food brands worldwide in 2018 – Statista.” https://www.statista.com/statistics/273057/value-of-the-most-valuable-fast-food-brands-worldwide

- “STORES Top Retailers 2018 – STORES: NRF’s Magazine.” https://stores.org/stores-top-retailers-2018

- “Italy – The Franchise Law Review – Edition 5 – The Law Reviews.” https://thelawreviews.co.uk/chapter/1159234/italy

- “McDonald’s USA, LLC, a joint employer, et al. – NLRB.” https://www.nlrb.gov/case/02-CA-093893?page=1

- “Wyndham Worldwide Corporation | Federal Trade Commission.” https://www.ftc.gov/enforcement/cases-proceedings/1023142-x120032/wyndham-worldwide-corporation

- “The Fishy History of the McDonald’s Filet-O-Fish Sandwich | Arts ….” https://www.smithsonianmag.com/arts-culture/the-fishy-history-of-the-mcdonalds-filet-o-fish-sandwich-2912